Those involved in the automotive industry today are witnessing a once in a generation shift toward a completely new type of mobility: electric vehicles.

Once considered a novelty, the modern electric vehicle offers hundreds of miles of range, fast charging times, and staggering performance in a wide variety of body styles. Over 100 EV models are currently on the market, with more models hitting the street every few months. As this shift towards electric vehicles becomes a reality, the aftermarket industry will be fundamentally altered.

As performance and personalization are redefined by electric vehicles, aftermarket companies must adapt to meet the growing consumer preference for battery and hybrid electric vehicles to stay successful.

Changes in vehicle components and systems

Simpler Drive trains

Electric vehicle (EV) drive trains are considerably more straightforward than internal combustion engines. They feature significantly fewer moving parts—typically fewer than 20 compared to hundreds in traditional vehicles. Fewer moving parts leads to lower maintenance needs and fewer opportunities for mechanical failures, potentially reducing revenue for traditional maintenance services but opening new service avenues specific to EV maintenance.

Battery systems

EV battery systems are complex and integral to vehicle performance, but they also pose aftermarket challenges due to their cost and degradation over time. The need for specialized skills to handle battery diagnostics, repairs, and recycling offers a growing market for aftermarket services tailored to these high-tech components, ensuring long-term vehicle performance and efficiency.

Electronic components

The increase in electronic components such as sensors and ECUs in EVs escalates the need for advanced diagnostic tools and software management in the aftermarket. This shift requires more sophisticated services, including software updates and cybersecurity, expanding opportunities for new revenue streams that cater to a technologically advanced vehicle infrastructure.

Evolving maintenance and repair needs

Reduced maintenance requirements

Electric vehicles (EVs) necessitate significantly less routine maintenance than internal combustion engines, largely due to their fewer moving parts and the absence of oil-based engine systems. This means no oil changes, fuel filters, or emissions checks, reducing the frequency and necessity of these traditional maintenance services. Consequently, this could diminish demand for such services in the automotive aftermarket, prompting service providers to adapt and possibly shift focus toward maintenance aspects unique to electric vehicles, such as battery health checks and electrical system inspections.

Specialized repair services

As electric vehicles become more prevalent, there’s a growing demand for specialized repair services that can handle their unique components, particularly the high-voltage battery systems and advanced electronics that underpin EV operations. This trend requires a new breed of technical expertise and specialized equipment, creating opportunities for aftermarket service providers to offer training and certification in EV technology. Software updates and modifications

Software controls many functionalities in electric vehicles, from battery management to driving modes and digital dashboards.

This integral role of software means continuous updates to enhance vehicle performance, address security vulnerabilities, and add new features. For the automotive aftermarket, this opens up opportunities in software management services. Providers can offer updates, patches, and modifications to optimize vehicle functions, ensuring that EVs continue to meet performance standards and consumer expectations post-purchase, thus establishing a critical role in the EV ecosystem.

EV impact on aftermarket parts sales

Decline in traditional part sales

The shift towards electric vehicles is expected to lead to a decline in sales of traditional automotive parts such as exhaust systems, fuel filters, and spark plugs, which are redundant in EVs. Aftermarket industries that have traditionally relied on these components will need to pivot their business models, either by diversifying their product lines to include EV-specific components or by developing new services geared toward the emerging needs of the EV market.

Rise in demand for new parts

Conversely, the rise of electric vehicles is anticipated to increase demand for specific new parts such as battery modules, cooling systems designed for battery temperature regulation, and advanced electronic interfaces that manage vehicle performance and connectivity. This shift represents a substantial growth area for the aftermarket sector. Companies that can innovate and supply high-quality, reliable parts that meet these new demands will likely see significant gains as the automotive market evolves toward electrification.

Ideas for aftermarket business diversification

Recycling and second-life uses for EV batteries

As the adoption of electric vehicles (EVs) increases, so does the opportunity for aftermarket businesses to recycle and repurpose EV batteries.

These batteries, once beyond their useful life in vehicles, can still be used in less demanding applications such as energy storage systems for homes or businesses. The process involves assessing the remaining capacity of batteries, refurbishing them if necessary, and then integrating them into new systems. This presents a lucrative business model and contributes to environmental sustainability by reducing waste and the demand for new raw materials.

Customization and performance enhancement

The EV market offers a new avenue for aftermarket industries to diversify into customization and performance enhancement specifically tailored to electric vehicles.

This can include upgrading battery management systems to increase efficiency and range, customizing software for improved vehicle dynamics, or enhancing user interface and connectivity features. As EV owners look to differentiate their vehicles, the demand for personalized adjustments will grow, providing an opportunity for innovative aftermarket providers.

Charging solutions and infrastructure

With increased EV ownership, the need for accessible and efficient charging solutions has also increased.

This is an opportunity for aftermarket businesses to design, sell, and install home and commercial charging stations. Beyond just providing hardware, there is scope for offering services related to the maintenance and upgrade of these charging systems, including integrating them with smart home networks or renewable energy sources for a more sustainable charging ecosystem.

Challenges and regulatory compliance

Safety and certification

Servicing electric vehicles (EVs) involves handling high-voltage systems, which poses significant safety risks. Technicians require specialized training and certification to manage these systems safely, preventing electric shocks and battery mishaps. This necessity for advanced skills and new tools introduces substantial investment barriers for traditional repair shops, necessitating updates in training programs and certifications to accommodate the technical demands of EVs.

Regulatory impact

As EV adoption grows, so do regulatory demands, with new environmental and safety standards specifically targeting electric vehicles.

These regulations can affect aftermarket businesses’ operations, from battery handling and disposal to repairs that maintain electronic integrity. Staying compliant requires aftermarket services to continually adapt and engage in the regulatory process, influencing policies that impact the sector. As regulations evolve to support reduced emissions and electrification, aftermarket services must align with these changes

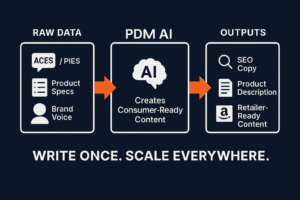

Partners in the electric age

Our advanced Product Information Management (PIM) solutions are designed to help you manage the complexities of electric vehicles, from parts management to regulatory compliance. With PDM Automotive, you gain a partner committed to innovation and equipped to support your business as you adapt to new technologies and changing regulations.

Contact PDM Automotive today to learn how we can help you thrive in the ever-evolving automotive industry and turn challenges into opportunities.

More Resources

2024 laws and regulation changes that may affect the automotive aftermarket

What is a PIM and and why it is important for aftermarket brands

Understanding the role of certifications and standards in aftermarket parts quality