Summary:

In 2025, the automotive aftermarket continues to be a thriving industry with remarkable growth, cutting-edge innovations, and a consistently shifting business climate. While experts do not expect these core elements to change in the next five years, industry analysts do see some major changes ahead for the aftermarket industry.

As we shift into a new, more ecologically conscious era, the aftermarket industry must balance the needs of drivers who own traditional internal combustion machines with the inevitable rising tide of alternative fuel vehicles such as battery electric vehicles, hybrids, and hydrogen-powered machines. Increased consumer interest in the outdoors, off-roading, and motorsports continues to boost the culture of customization, which has propelled the industry forward for decades and will shape the business landscape over the next several years.

Let’s explore the future of our industry to get a glimpse at what’s ahead.

Electrified vehicles, including electric vehicles (EVs) and hybrids, are rapidly reshaping the automotive landscape and the way we do business.

According to Cox Automotive, electrified vehicles are projected to account for 25% of total U.S. auto sales, with pure EVs expected to capture a record 10% market share, up from 7.5% in 2024. As consumer demand for sustainable mobility rises, the automotive industry—and particularly the aftermarket—must adapt to meet the evolving needs of this expanding market.

The electrification of vehicles is not just a trend; it’s a transformation.

EVs eliminate internal combustion engines entirely, while hybrids bridge the gap between traditional gasoline-powered vehicles and full electrics. Together, these technologies represent a massive shift in vehicle design, functionality, and maintenance. For aftermarket manufacturers, this creates unprecedented opportunities to develop products and solutions that cater to the unique demands of these vehicles.

Autovista lays out the future in their EV Volumes reporting. Despite challenges in Europe, where reduced subsidies and economic pressures have dampened growth, other regions are driving momentum. China continues to lead, far exceeding its NEV targets, with PHEVs gaining popularity and government incentives supporting adoption. By 2035, EVs are forecasted to account for 69.5% of global light-vehicle sales, reflecting widespread adoption and technological advancements.

In the U.S., this growth is evident in sales surges; the fourth quarter of 2024 alone saw EV sales jump 12% to 356,000 units, driven by attractive incentives and enhanced consumer awareness. Hybrid vehicles, meanwhile, continue to appeal to drivers seeking improved fuel efficiency without the range concerns of full EVs.

Together, these electrified vehicles are shaping a dynamic future for the automotive aftermarket.

As electrified vehicles become more mainstream, they bring new aftermarket demands, replacing traditional parts with components tailored to their unique systems.

For Electric Vehicles (EVs):

These specific components present an untapped market for aftermarket companies to innovate and cater to electrified vehicles.

The rise of electrified vehicles introduces unique challenges for the aftermarket industry.

New Skill Sets for Repairs:

The transition to EVs and hybrids requires repair technicians to acquire advanced skills in electrical engineering, software diagnostics, and battery management systems. Unlike traditional repairs, servicing these vehicles often involves handling high-voltage systems and advanced electronics. Training programs and certifications tailored to EV and hybrid repairs are critical for shops aiming to remain competitive.

Changes in Parts Demand:

Electrified vehicles significantly shift the focus of parts demand. For example:

These shifts require aftermarket companies to reevaluate their offerings and strategically pivot toward electrified vehicle needs.

Electrified vehicles represent both a challenge and an opportunity for the automotive aftermarket. To succeed in this rapidly evolving space, businesses must invest in developing products and services that align with the needs of EVs and hybrids. Key strategies include:

Savvy businesses that adapt now will not only meet the demands of today’s drivers but also pave the way for long-term success in a sustainable automotive ecosystem.

As the industry moves forward, substantial technological advancements in the realms of AI and 3D printing will allow manufacturers to work faster and more efficiently.

Predictive maintenance in the automotive aftermarket involves using AI algorithms to analyze data from vehicle sensors and service histories.

This technology can forecast potential failures and suggest maintenance before breakdowns occur. The benefits include reduced vehicle downtime, lower repair costs, and increased safety. Predictive tools can also tailor maintenance schedules based on actual vehicle usage rather than standard intervals, optimizing part replacements and service bookings.

AI is reshaping the way aftermarket products are conceptualized, developed, and brought to market.

By harnessing AI’s analytical capabilities, manufacturers can design parts precisely tailored to specific vehicle requirements. AI algorithms process extensive data on vehicle performance, usage patterns, and environmental conditions, providing insights that guide the development of optimal product specifications. This data-driven approach not only improves the performance and durability of aftermarket components but also enables the creation of innovative, highly customized solutions. As a result, manufacturers can differentiate themselves in a competitive market by delivering products that are uniquely aligned with customer needs and expectations.

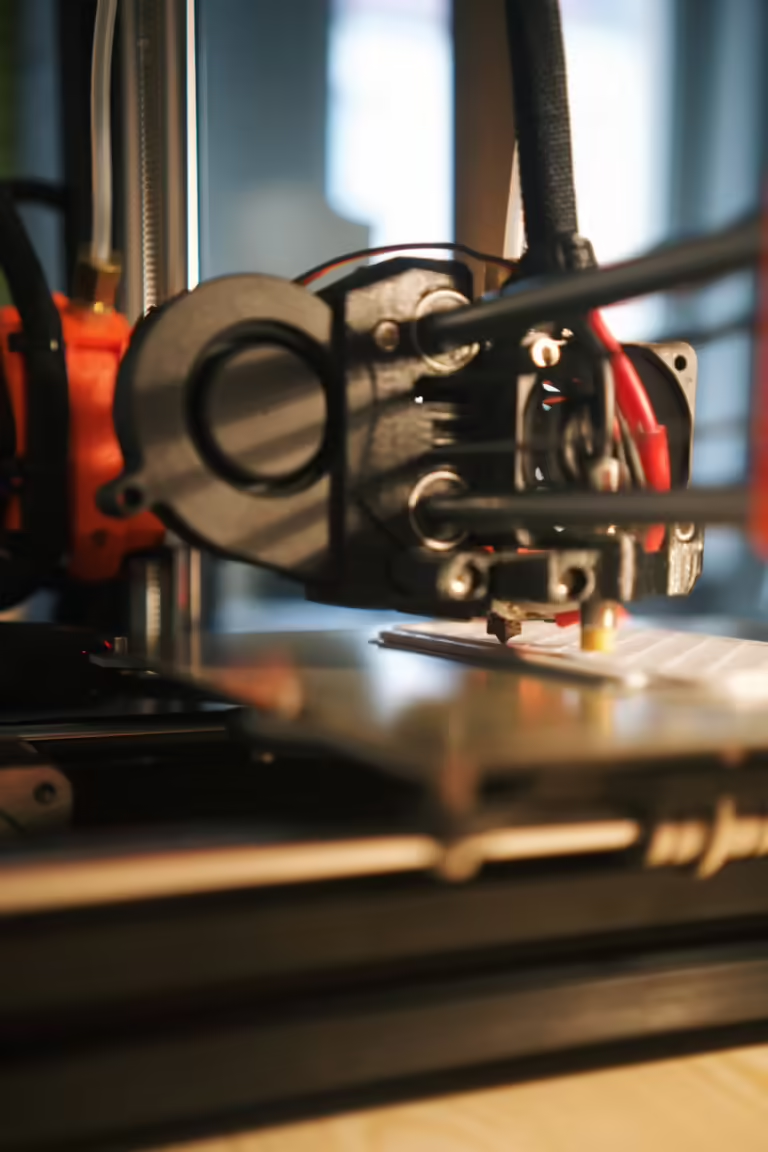

3D printing, or additive manufacturing, is poised to revolutionize the automotive aftermarket supply chain.

This technology reduces the need for extensive inventory holdings, as parts can be printed on demand. Additionally, it allows for the decentralization of production; parts can be manufactured quickly at or near the point of need, reducing lead times and transportation costs. This shift can lead to more resilient supply chains that are less susceptible to disruptions like those caused by global logistics issues.

The ability to produce parts on demand via 3D printing offers significant benefits for the automotive aftermarket.

It enables the production of low-volume, niche, or even obsolete parts economically, which are otherwise unfeasible with traditional manufacturing due to molds and setup costs. For instance, classic car restorers can benefit from the ability to produce parts that are no longer available on the market. 3D printing allows for rapid prototyping and testing of new aftermarket parts, accelerating innovation and introducing new products to the market.

How people buy the products they want and interact with the brands they love is changing rapidly, especially in the automotive aftermarket.

The automotive aftermarket has seen a significant shift towards e-commerce, with more consumers opting to purchase auto parts online.

This trend has been accelerated by broader e-commerce growth trends and changing consumer behaviors, especially during the COVID-19 pandemic. Online sales offer convenience, competitive pricing, and a wider selection of products. For aftermarket companies, this means enhancing their digital storefronts, optimizing online catalogs, and integrating advanced search tools to improve customer experience. Embracing digital sales channels can lead to increased reach and market penetration, especially in less-served geographical areas.

Digital platforms have become vital for customer engagement in the automotive aftermarket.

Companies are leveraging websites, mobile apps, and social media to connect with customers, provide personalized shopping experiences, and offer targeted promotions. Features such as live chat support, augmented reality (AR) tools for visualizing car parts, and virtual ‘try-on’ services enhance the online customer journey. These platforms also allow for the collection and analysis of customer data, enabling companies to better understand consumer needs and preferences, thus driving sales and improving service offerings.

There is a growing trend towards vehicle personalization and customization, driven by consumers’ desires to stand out and tailor their vehicles to fit personal tastes and lifestyles.

This trend is evident in various segments, from luxury car owners to off-road enthusiasts. The aftermarket industry can capitalize on this by offering customizable options such as body kits, custom paint jobs, bespoke interiors, performance enhancers, and technologically advanced accessory upgrades like LED lighting and smart infotainment systems. Catering to these desires not only meets customer demand but also adds value to the aftermarket offerings, potentially increasing revenue.

The demand for customization opens up opportunities in niche markets that cater to specific consumer segments.

For instance, there is a growing market for eco-friendly and sustainable automotive products, such as biodegradable lubricants and recycled materials for interior parts. Similarly, the rise in electric vehicles creates a niche for custom EV accessories, including aesthetic modifications and performance parts. Another niche market includes vintage and classic car restoration, where enthusiasts seek authentic or replica parts that are often not available through mainstream suppliers. Off-road vehicles are also on an upward trend, promoted by America’s desire to get out and enjoy the great outdoors.

By focusing on these niche markets, aftermarket companies can differentiate themselves and build a loyal customer base.

Global economic conditions are presenting an interesting opportunity for aftermarket companies looking to capture the hearts and minds of enthusiasts in developing countries.

Emerging markets in Asia, Africa, and Latin America represent significant growth opportunities for the automotive aftermarket industry.

These regions are experiencing rapid economic development, urbanization, and increases in vehicle ownership, which in turn drives demand for automotive parts and services. Factors such as improving road infrastructure and increasing consumer spending power contribute to a burgeoning automotive market. Companies can tap into these markets by understanding regional preferences and adapting their offerings to meet local demands, such as parts suitable for rugged terrains or vehicles commonly used in these regions.

Successful market expansion often requires localizing products and services to meet the specific needs and preferences of different regions.

This may involve adapting products for local climates, road conditions, or vehicle types predominant in those markets. Additionally, cultural considerations can influence marketing strategies and customer service approaches. Companies might need to offer products with local language packaging and instructions, and customer support in the local language to effectively connect with and serve these new customer bases.

Globalizing the supply chain can offer substantial rewards, such as reduced costs, improved efficiency, and access to new markets.

However, it also introduces risks, including political instability, regulatory changes, and potential disruptions from natural disasters or pandemics. Companies need to assess these risks carefully and develop strategies to mitigate them. Diversifying suppliers and manufacturers across different regions can reduce dependency on any single source and increase supply chain resilience.

Tariffs continue to create ripples across the global economy, introducing uncertainty for manufacturers, suppliers, and consumers. In the automotive industry, tariffs on imported parts and raw materials can significantly raise production costs, disrupt supply chains, and delay product availability. For aftermarket manufacturers, these challenges often translate into higher prices for consumers or reduced profit margins. The fluctuating trade landscape also complicates long-term planning, making it critical for businesses to adopt adaptive strategies to mitigate risks and maintain competitiveness in a volatile market.

Effective management of global logistics is crucial for automotive aftermarket companies operating on an international scale.

Strategies to enhance logistics include implementing advanced supply chain technologies like GPS tracking, RFID, and AI-driven logistics platforms that optimize shipping routes and inventory management. Establishing regional distribution centers can also help in reducing delivery times and costs, ensuring faster market responsiveness. Furthermore, forging strong relationships with local logistics providers can enhance supply chain efficiency and ensure compliance with local regulations and cultural norms.

Strategic alliances and mergers in the automotive aftermarket industry are pivotal maneuvers that catalyze innovation, expand market reach, and solidify brand presence in an increasingly competitive landscape. Expect to see more mega mergers and acquisitions in the coming years.

Strategic partnerships in the automotive aftermarket often focus on sharing technology and collaborative research and development (R&D) to accelerate innovation.

These alliances enable companies to pool their resources, expertise, and technology to develop new products more efficiently and cost-effectively. For example, a company specializing in electronic components might partner with another that excels in software development to create advanced telematics or infotainment systems for vehicles.

Such collaborations can lead to breakthrough innovations that might not be feasible for each partner independently due to financial or technological constraints.

Strategic partnerships can also facilitate market expansion and strengthen brand presence. By aligning with local or regional companies, a business can gain quicker access to new markets with the established reputation and customer base of its partner.

This approach is particularly effective in markets where local knowledge and presence are crucial for success. Additionally, such alliances often lead to brand consolidation, where two brands merge their identities to strengthen market position and consumer trust, thus leveraging the strengths of both companies.

One notable example of strategic alliances in the automotive aftermarket is the merger between Pep Boys and Auto Plus, which was orchestrated by Icahn Enterprises. This merger created one of the largest automotive aftermarket service and parts networks in the U.S., aiming to leverage combined resources for better service delivery, expanded offerings, and stronger market presence.

Another significant case is the alliance between Bosch and Continental, two of the largest automotive parts suppliers in the world. They collaborated on enhancing mobility solutions, particularly in the realm of connected and autonomous vehicle technologies. This partnership allows both companies to share technological developments and access broader markets with their combined innovations.

These cases exemplify how strategic partnerships and mergers can be utilized not only to enhance technological capabilities and expand market reach but also to consolidate brand presence and respond more effectively to the evolving demands of the automotive industry. Such strategies are crucial in a landscape increasingly characterized by rapid technological advancements and intense competition.

As the automotive aftermarket evolves with new technologies and market dynamics, partnering with a knowledgeable ally like PDM can ensure your business not only adapts but thrives.

Contact PDM today to discover how our expert guidance and tailored solutions can help you navigate these changes and position your company for future success.

Necessary cookies are absolutely essential for the website to function properly. This category only includes cookies that ensures basic functionalities and security features of the website. These cookies do not store any personal information.

Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc.

Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads.

Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet.